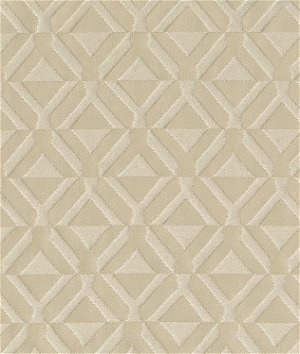

Ralph Lauren Scrimshaw "EDGE Of THE SEA" Italian Cotton Nautical Matelasse Fabric - LFY65141F - Retails 244 yd - Below Wholesale - 4.7 yds | Schooner Chandlery

Flutter Angora Matelasse | Fabric Store - Discount Fabric by the Yard | Discount fabric, Fabric wallpaper, Fabric store

Blue Matelasse Fabric: Fabrics from Italy by Ruffo Coli, SKU 00060180 at $99 — Buy Luxury Fabrics Online

Blue Pineapples Woven Matelasse Upholstery Grade Fabric By The Yard - Beach Style - Upholstery Fabric - by Palazzo Fabrics | Houzz